Auto Title Loan Interest Rates*

We compare several top lenders and give you an idea of how much you might pay for an auto title loan finance charge.

We compare several top lenders and give you an idea of how much you might pay for an auto title loan finance charge.

Short-term loans can be expensive and auto title loan interest rates are no exception. It’s the price you pay when you need money fast. While you won’t know the exact fees until your lender tells you (usually in the loan agreement), it is possible to get a general, ballpark figure for your auto title loan interest rate.

How Much Should I Expect to Pay for an Auto Title Loan?

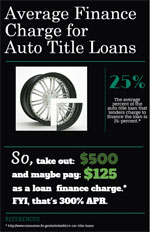

The first question people usually ask about this type of loan is: How much can I get with an auto title loan? Then, the next question is almost always about how much the loan will cost. According to the Federal Trade Commission, car title loans are usually around 25-percent to 50-percent of what the lender decides the car is worth. The loans tend to be from $100 to $5,500. On average, the APR for this type of loan starts at 300-percent. That number is derived from the average monthly rate lenders charge to finance the loan: 25-percent.

Of course, we’re talking about averages here. So you could pay less or more. Still, let’s look at an example using these numbers. If you were to take out a $500 loan and pay it off in 30 days, you’d be looking at $125 in interest (again, this is just an example based on averages – your rates will likely be different). Then, there will probably be other fees tacked on to that.

If you can’t pay off the loan in those first 30 days, you will need to pay extra fees and interest. Going back to our example from before, if you were only able to pay off the original interest (which was $125) on your $500 loan during the first 30 days, then you would need to “roll over,” or enter into a new loan with the same lender. This new loan would have new interest and fees. That’s why it’s so important to pay off your loan without rolling over into a new loan.

Auto Title Loan Interest Rate Examples

So far we’ve been working from the averages reported by the FTC. Let’s look at some real-life examples. We researched a few of the top lenders that provide sample interest rates. Here’s what we found.

- Most lenders won’t give you a sample interest rate up front. They want you to apply for the loan first. These lenders will list their interest rates as “competitive” or “low” but not give a sample rate.

- A California car title loan company said that its interest rates are usually from 5-percent to 10-percent.

- A Florida title loan company said it charges $25 for every $100 borrowed.

- A Nevada title loan company said it charges $25 for every $100 borrowed

- An Arizona title loan company said it charges a 5-percent monthly rate on the principal unpaid balance.

- An Idaho title loan company said its rates were lower than 300-percent APR. It did not list how much lower.

- A Utah title loan company said its rates were around 120-percent APR. This company also listed the average rates of two of its competitors, which were quoted at 240-percent APR and 300-percent APR.

The Danger of High Interest Rates

If you pay off your auto title loan before the end of your original loan term, then you likely won’t run the risk of falling into a cycle of debt, which occurs when you roll over your loan without substantially reducing the principal owed. Borrowers who regularly roll over their loans might eventually end up paying more in fees than their car is worth. If these fees become too much of a burden, the borrower can be forced to default on their loan. In the case of auto title loans, this means that the borrower loses their automobile.

Are there Low Interest Auto Title Loans?

Most auto title loans have a higher interest rate than what you’d find at a traditional bank. Although, there are some car title loans that have lower interest rates. These are usually not marketed as an auto title loan, but still require you to use your car as collateral. If you are interested in this type of loan, we recommend searching for: “low interest secured loans.” You should know, though, that generally speaking, the lower the interest rate, the better your credit will need to be.

Are Auto Title Loans Worth It?

The high interest rates and risk of losing your car make auto title loans a hard financial product to recommend to anyone who can qualify for a different type of loan. But if you need the money now and your credit doesn’t allow for a bank loan, your best option might be an auto title loan. Just try to pay it off as fast as you can. People get into trouble with this type of loan when they can’t pay it off fast enough and the fees start building up. As long as you pay off the auto title loan interest rate and principle without rolling over, this can be a viable source for emergency cash.

*The average interest rates listed in this blog may or may not represent the interest rates quoted to you by your specific lender. You should read your loan agreement over carefully to fully understand the fees and charges related to your loan.